Campaign Finance Reports & Information

For a list of Campaign Finance Reports filed with the Town Clerk's office, click here. |

The Campaign Finance Law (M.G.L. Chapter 55) governs the financing of political campaigns in the Commonwealth at the State, county, district, and municipal levels. Campaign Finance Reports for the Town of Belmont's Town-wide elected officials and Local Ballot Question Committees are filed with the Belmont Town Clerk following the requirements of the Office of Campaign and Political Finance (OCPF).

| Need Additional Guidance? |

|---|

| website: MA OCPF |

| email: ocpf@mass.gov |

| phone: (617) 979-8300 |

Massachusetts Office of Campaign and Political Finance

McCormack State Office Building

1 Ashburton Place, Room 411

Boston, MA 02108

2023 UPDATE - CURRENT ELECTED OFFICIALS, PLEASE READ BELOW:

- The candidate has not received any contributions.

- The candidate has not made any expenditures (including with their own funds or personal credit cards).

- The candidate has not incurred any obligations (liabilities).

- The candidate does not have a campaign fund in existence.

- The candidate does not have a political committee.

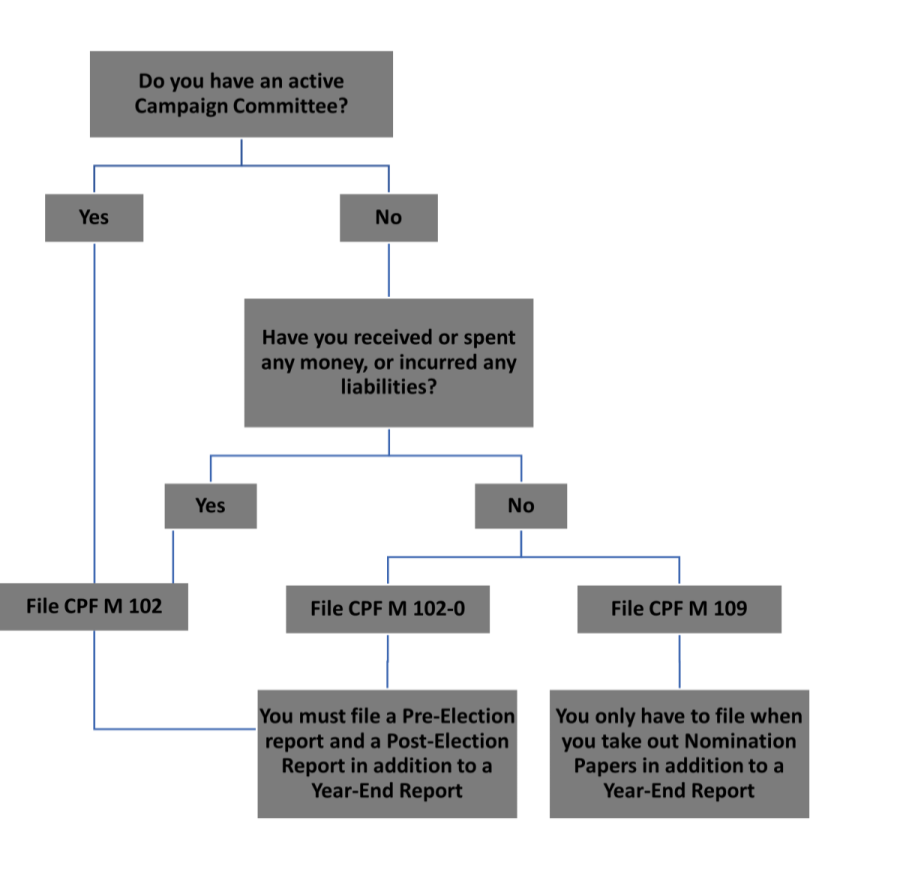

The M109 form is used for the convenience of a candidate and the Town Clerk's office to eliminate the requirement to file periodic campaign finance reports during an election year.

For example, if an incumbent elected official has no activity, no balances and no committee, they may choose to file this form when receiving their nomination papers. If this form is filed, there is no obligation to file pre-election or post-election reports. Candidates who file the CPF M109 form must still file the year-end report.

Click here for Newsletters from the Office of Campaign and Political Finance.

Reporting Campaign Finances With the Town Clerk

| Candidates Running for Town-wide Elected Office | Form to File |

|---|---|

| Statement of Organization of Candidate Committee | M101 |

Municipal Campaign Finance Report | M102 |

| Municipal Campaign Finance Report - (No Financial Activity) | M102-0 |

| Statement of Candidate Not Raising or Expending Campaign Funds | M109 |

| Amendment to Campaign Finance Report | 102 A |

| Change of Treasurer/Acceptance of Office by New Treasurer | T 101 |

| Change of Purpose (Office Sought) | 101 P |

Itemization of Reimbursements Form | M R 1 |

Reports for Town-wide office are filed on a periodic schedule, eight days before an election (pre-election) and 30 days afterward (post-election). Year-end reports are also filed for active candidate and ballot question committees, due on January 20th.

In lieu of an M102-0 form, municipal candidates may also file an M109 form. The M109 form is used for the convenience of a candidate and the Town Clerk's office to eliminate the requirement to file periodic campaign finance reports during an election year. An incumbent elected official, that meets the 5 criteria listed above needs to file only once when they receive their nomination papers and again for the year-end reporting.

Reports will not be accepted unless they contain the original signature of the candidate and, if applicable, the treasurer.

Forming a Ballot Question Committee

| Ballot Question Committees | Form used |

|---|---|

| Statement of Organization of Ballot Question Committee | CPF M101 BQ |

| Pre/Post Election Filing & Dissolution | CPF M 102 |

| Amending receipts, expenditures or balances | CPF 102A |

| Itemized reimbursement (in excess of $50) | CPF R1 |

| Ballot Question Expenditures by Corporation, Organization or Individual | CPF M22 |

Municipal ballot question committees are organized to support or oppose questions locally. A ballot question committee should be formed if two or more individuals or entities pool resources to support or oppose a ballot question.

Getting Started:

- Organize with an M101 BQ form. The form is filed with the Town Clerk's office. The ballot question committee will need a treasurer and a chair. The treasurer can also be the chair, but cannot be an appointed public employee.

- Open a standard checking account to deposit contributions. You will need an EIN from the IRS to open a bank account. The OCPF has provided a 4-minute tutorial video

- Deposit contributions into the committee bank account and track the names and address of each donor. If a contribution is $200 or more, and provided by an individual, his or her occupation and employer is also required.

Reporting:

- Reports are filed on paper with local election officials, disclosing receipts, expenditures, in-kind contributions and liabilities.

- OCPF Recommendation: Make expenditures by committee check or committee debit card.

- Ballot question committees may need to file sub-vendor reports, if the committee pays a vendor $5,000 or more in the year, and the vendor makes expenditures of $500 or more on behalf of the committee.

- Some ballot question committee communications require disclaimers. Please see this guide.

- When the question is decided by the voters, the ballot question committee should begin to dissolve. To dissolve, the committee can pay its debts, and then donate the remaining balance to charity, a scholarship fund, a municipality or the state.

What a Ballot Question Committee Can and Cannot Do:

- Dark Money: The campaign finance law prohibits disguising the true source of funds. For example, a donor should not contribute money to a non-profit organization for the purpose of those funds then being donated to a ballot question committee, disguising the true source of the funds.

- Ballot question committees can receive unlimited amounts of money from individuals, entities, committees and other organizations. Click here for a limits chart.

- Ballot question committees can receive money from corporations, LLCs, LLPs, S-Corps and partnerships.

- Ballot question committees can make expenditures to support the purpose for which it was formed. For example, advertisements, mailings and signs to support or oppose a question are permitted. A clear "purpose" for an expenditure is required. Example: "Hall rental for campaign kickoff.

- Ballot question committees cannot contribute to candidates.

Public Officials in support or against a ballot question should review Interpretive Bulletin IB-92-02.

Additional topics relating to municipal ballot questions found in the Interpretative Bulletins and publications on the OCPF website.

By law, ballot question committees must dissolve after the final determination of the question at the polls. A committee may remain open after an election in certain limited circumstances, such as a question that is defeated in a town election but is promptly re-voted at a subsequent election.

Dissolving a Political Committee

OCPF offers a step-by-step guide to find out how and when to dissolve a political committee here.

Elected officials who hold active office may not dissolve their committees. However, once they leave office, they may dissolve their committees once all outstanding liabilities have been satisfied and there are no remaining funds in their campaign accounts.

This does not mean that candidates are required to dissolve their committees upon leaving office. A candidate may leave his or her committee open as long as the candidate has not ruled out the option of seeking office in the future, even if the specific office and timetable are not known. The committee must continue to comply with all provisions of the campaign finance law and file regular disclosure reports. Dissolution is only required in those instances where a candidate has decided not to seek elected office in the future or upon the death of a candidate.

In order to dissolve, a committee must have no remaining funds or liabilities. Liabilities, including any unpaid bills or loans from a candidate, must be paid, settled, or otherwise disposed of before dissolution. The payment of any debts will be disclosed as expenditures on the final disclosure report filed by the committee.

- The General Fund

- A charitable or religious organization

- A scholarship fund

- The general fund of any city or town

Those unsure whether a planned expenditure of residual funds complies with the legal standard should contact OCPF.

Dissolution is accomplished by filing a final CPF M 102 campaign finance report detailing the disposition of funds and liabilities and checking the box marked "Dissolution" as well as the appropriate type of report (8 days, 30 days after or year end).

The reporting period for this report will begin the day after the last campaign finance report was filed and will end on the date of filing.